Boards often devote plenty of time to succession planning and the compensation aspects of the CEO position, but a key piece involves the second in command. Even if the new CEO pick is the right choice, changes at the top can destabilize the C-suite, particularly if the CFO isn’t meshing with the CEO or feels left out of the transition process. Boards are increasingly being advised to develop succession planning processes for the CFO role that mirror the CEO’s succession plan to prepare for various eventualities.

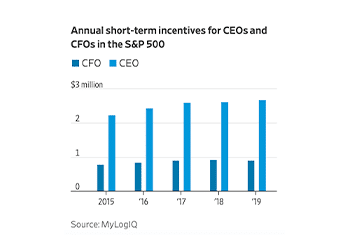

So far this year, 17 CFOs have retired or resigned their positions after the appointment of a new CEO, according to data from public company intelligence provider MyLogIQ. The number was 26 in 2020 and 23 in 2019. The findings underscore the delicate and important dynamic between the two executives that may become strained. New CEOs often implement strategic shifts, particularly if they come from outside the company. Meanwhile, the CFO may have come in second place for the CEO position and could be harboring some bitterness. In addition, general communication and personality conflicts can also be a factor, former CFOs, board members and consultants said.